VIKSIT BHARAT BANKING STRATEGY

The conference featured insightful discussions on various topics related to the banking industry, including digital innovation, operational transformation, and sustainable lending practices. Industry experts and thought leaders shared their perspectives on the challenges and opportunities faced by the sector, emphasizing the need for collaboration between banks, regulators, and the government to build a resilient and future-ready banking ecosystem in India.

In addition to the conference sessions, FIBAC 2024, with the focus on the theme “Banking for a Viksit Bharat.” also witnessed the launch of a report highlighting key themes essential for the stability, profitability, and growth of the Indian banking sector. The report outlined strategies for banks to embrace digital innovation, reimagine their operations, and foster sustainable lending practices to support India’s economic transformation.

Overall, FIBAC 2024 proved to be a valuable platform for industry professionals and stakeholders to engage in meaningful dialogues and contribute to shaping the future of India’s banking sector. With a focus on promoting a strong and inclusive financial ecosystem, the conference emphasized the critical role of the banking industry in driving India’s progress toward a prosperous and self-reliant nation. This year’s conference gathered industry stalwarts and global thought leaders to discuss key emerging issues and strategies for the Indian banking industry’s future. The Boston Consulting Group (BCG) will serve as the Knowledge Partner for the event, providing valuable insights and expertise.

As India aims to become a developed nation by 2047, the financial sector must play a crucial role in driving consistent and sustainable economic growth. FIBAC 2024 emphasized the importance of a growth-oriented, vigilant, and resilient financial sector in achieving this ambitious goal. Key discussions revolveed around stability, resilience, and the structural themes necessary for the industry’s progress.FIBAC 2024 presented an unparalleled opportunity for banking and financial professionals to engage in meaningful dialogue, explore innovative strategies, and contribute to shaping the future of India’s banking sector.

During his address at FIBAC 2024, Reserve Bank of India Governor Shaktikanta Das expressed confidence in India’s growth trajectory, driven by key economic factors gaining momentum. Despite global challenges, the Indian economy has shown resilience and is expected to grow at a robust pace.

According to a recent report, India’s GDP is projected to grow between 6.5% and 6.8% in the current fiscal year and between 6.7% and 7.3% in the following year. This consistent growth, coupled with strong macro fundamentals and purposeful policy interventions, has positioned India as the fastest-growing major economy globally.

Das acknowledged the pivotal moment in India’s economic journey, highlighting the transformative reforms of the past decade that have propelled the country to the global stage. With a focus on infrastructure development, digital transformation, and energy transition, India is well-poised to become a developed nation by 2047.

The Indian economy has experienced a 66% growth over the past decade, elevating its status to a $3.8 trillion economy. This achievement can be attributed to landmark reforms such as the Goods and Services Tax (GST), which have facilitated economic integration and streamlined tax administration.

As India continues to demonstrate strong economic growth and a positive outlook, it has become an attractive destination for foreign direct investment. This investment influx has further fueled the nation’s development, solidifying its position as a global economic powerhouse and a key player in the international arena.“

Our nation’s progress toward becoming an advanced economy is supported by a unique blend of factors: a young and dynamic population, a resilient and diverse economy, a robust democracy, and a rich tradition of entrepreneurship and innovation,” Das said.

According to recent statements from Reserve Bank of India Governor Shaktikanta Das, India’s economy has demonstrated a strong recovery from the COVID-19 downturn, with an average annual growth rate of 8.3% over the past three years. The RBI projects a growth rate of 7.2% for the current financial year, while the International Monetary Fund (IMF) forecasts 7% growth, and the World Bank estimates a 7% growth for the 2024-2025 fiscal year.

The Indian economy has showcased resilience and consistent growth, positioning itself as the fastest-growing major economy globally. This achievement has been facilitated by various factors, such as a strong consumer demand, significant infrastructure development initiatives, and effective policy measures implemented by the government.

Recent data also indicates that India’s economy crossed a crucial milestone, with its quarterly nominal GDP surpassing the $1 trillion mark for the first time. This accomplishment highlights the nation’s progress and bolsters its ambitions of becoming a developed nation by 2047 or 2050.

As India continues to grow and set new economic records, it is essential to address potential challenges and ensure that the benefits of this growth are distributed equitably. By maintaining a focus on sustainable development and implementing effective policies, India can pave the way for a prosperous future and realize its vision of a Viksit Bharat.“

Data shows that the fundamental growth drivers of the economy are gaining momentum. This gives us the confidence to say that the Indian growth story remains intact,” Das said.

According to Reserve Bank of India Governor Shaktikanta Das, private consumption, which constitutes 56% of India’s GDP, experienced a growth rate of 7.4% in the first quarter of this year. This marks a significant increase from the 4% growth observed in the second half of the 2023-2024 fiscal year, signaling a revival in rural demand.

Das highlighted the importance of private consumption as the main driver of aggregate demand, accounting for a substantial portion of the country’s economic activity. The recent uptick in private consumption indicates a positive trend in the overall economic growth of India.

The strong growth in consumption during this period occurred despite uneven monsoon conditions and an intense heatwave. Experts attribute this improvement to favorable labor market conditions, the moderation of retail inflation, and positive rural demand indicators, such as an increase in two-wheeler sales.

Governor Das further emphasized the growth of private consumption and investment, as well as the expansion of credit to the agriculture and industrial sectors. These factors demonstrate the resilience of the Indian economy and its potential for sustained growth in the future.

As the economy moves toward a more balanced growth model, it is essential to continue monitoring these trends and addressing potential challenges to ensure long-term stability and prosperity.

Reserve Bank of India Governor Shaktikanta Das noted that investment, which accounts for 36% of India’s GDP, is growing at a steady pace of 7.5%. Combined with the growth in private consumption, over 90% of the country’s GDP is expanding robustly.

From a supply-side perspective, while agriculture experienced a modest growth of 2% in the first quarter, it is expected to perform better in the remaining months of the year. This optimism is based on factors such as good monsoon progress, successful sowing of kharif crops, and favorable moisture conditions for the upcoming rabi crops. Additionally, industry and services sectors recorded growth rates of 7.4% and 7.7%, respectively.

The strong growth across various sectors demonstrates the resilience and potential of the Indian economy. To maintain this momentum and ensure long-term growth, it is crucial to focus on sustainable development strategies, address potential challenges, and promote a balanced economic model that benefits all citizens.

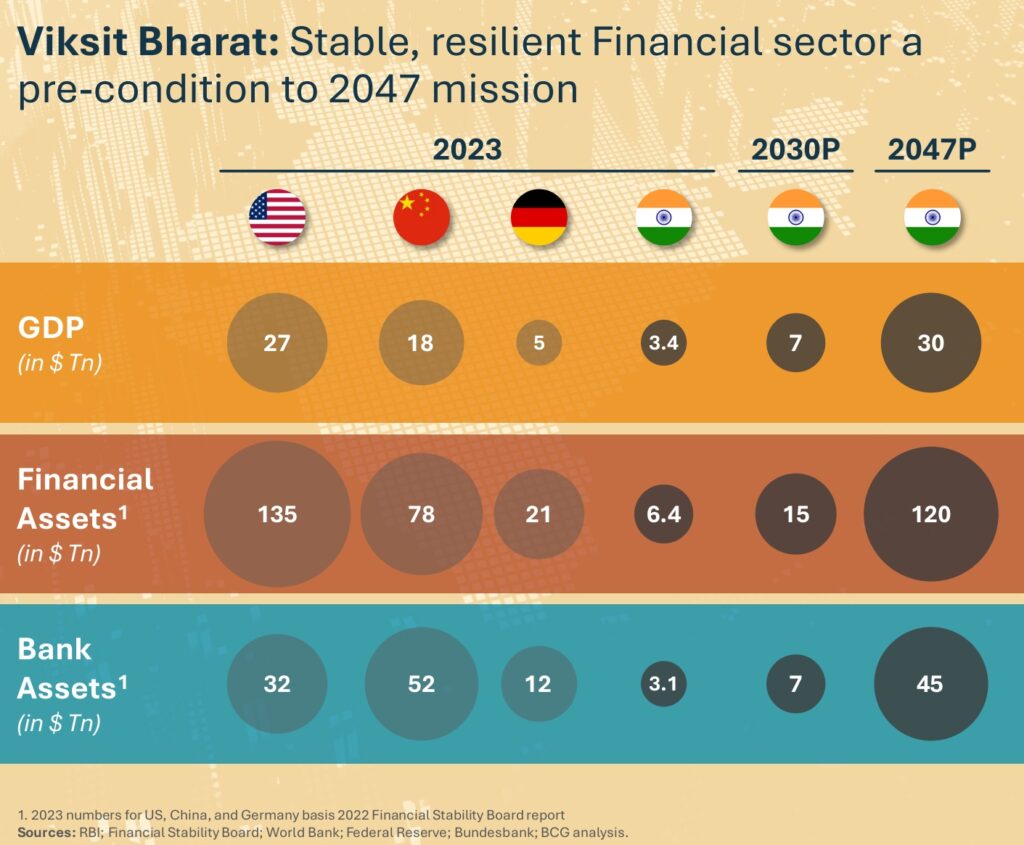

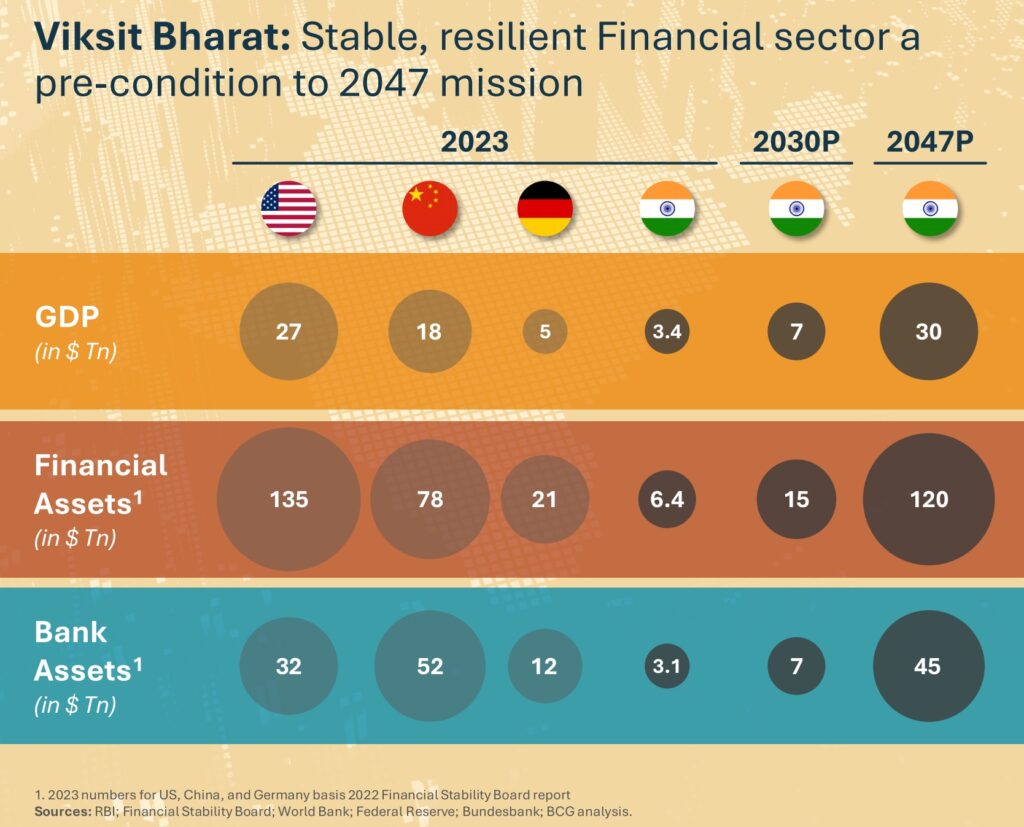

As India sets its sights on becoming a developed nation by 2047, marking the 100th year of independence, the country has established an ambitious agenda to achieve a $30 trillion GDP. This goal, which serves as a symbol of India’s commitment to growth and progress, will require concerted efforts from all sectors and stakeholders to realize.

To reach this ambitious target, the government has been actively implementing various initiatives and policies aimed at promoting economic development, fostering innovation, and encouraging foreign investments.

The FIBAC 2024 event, organized in association with the Federation of Indian Chambers of Commerce and Industry (FICCI) and the Indian Banks’ Association (IBA), launched a report highlighting the Indian banking industry’s potential to serve as an ideal launchpad for the Viksit Bharat mission.

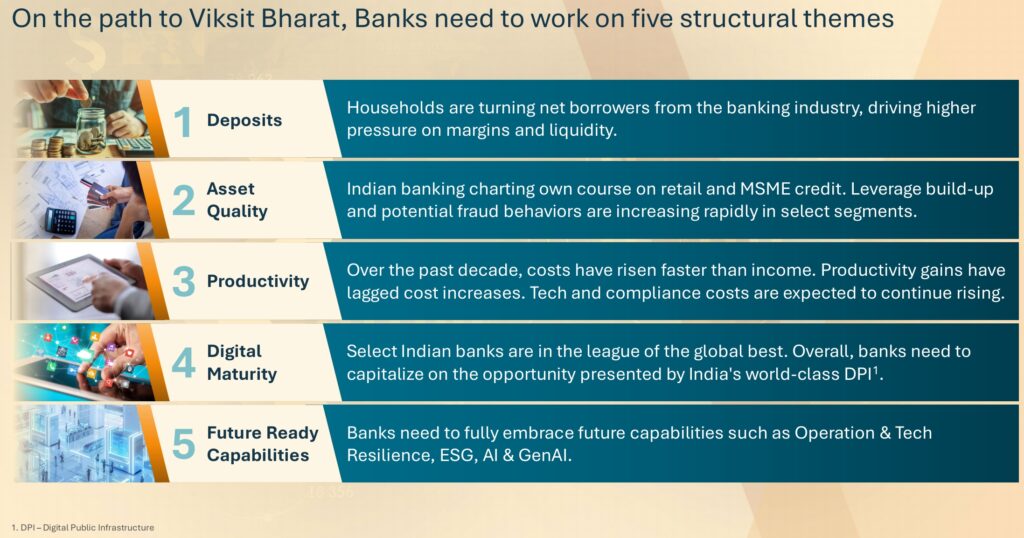

The report identifies five structural themes that the industry needs to focus on in order to achieve sustainable growth and contribute to India’s vision of becoming a developed nation by 2047:

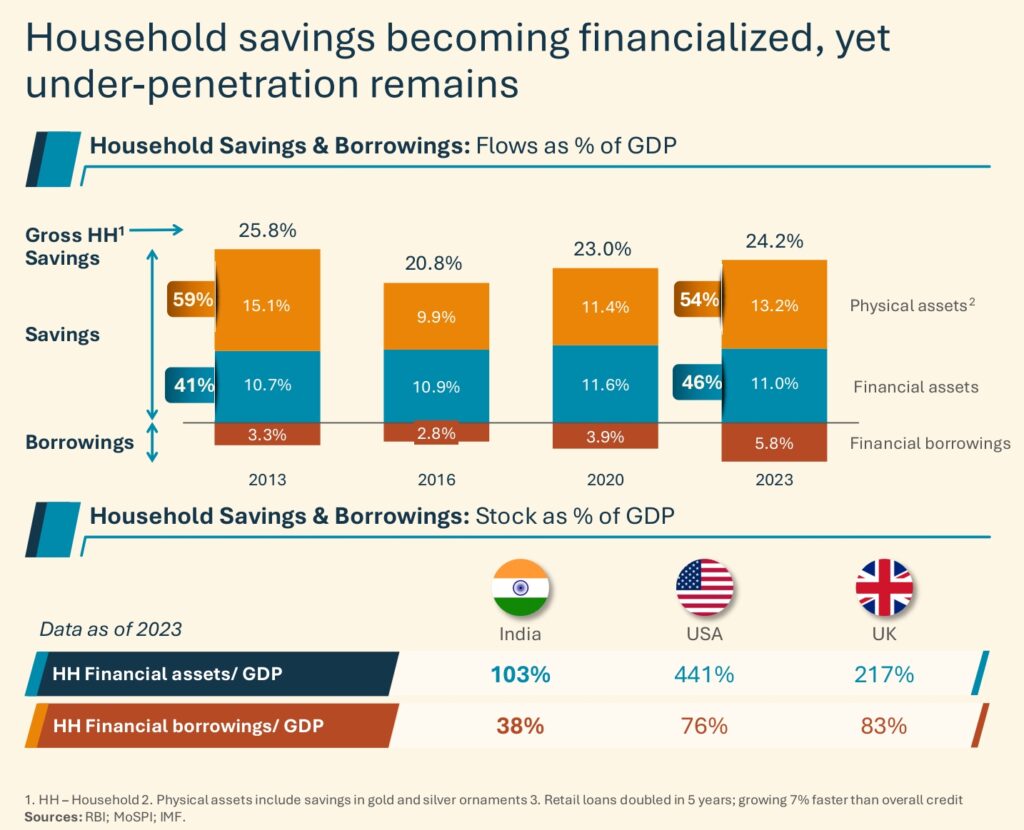

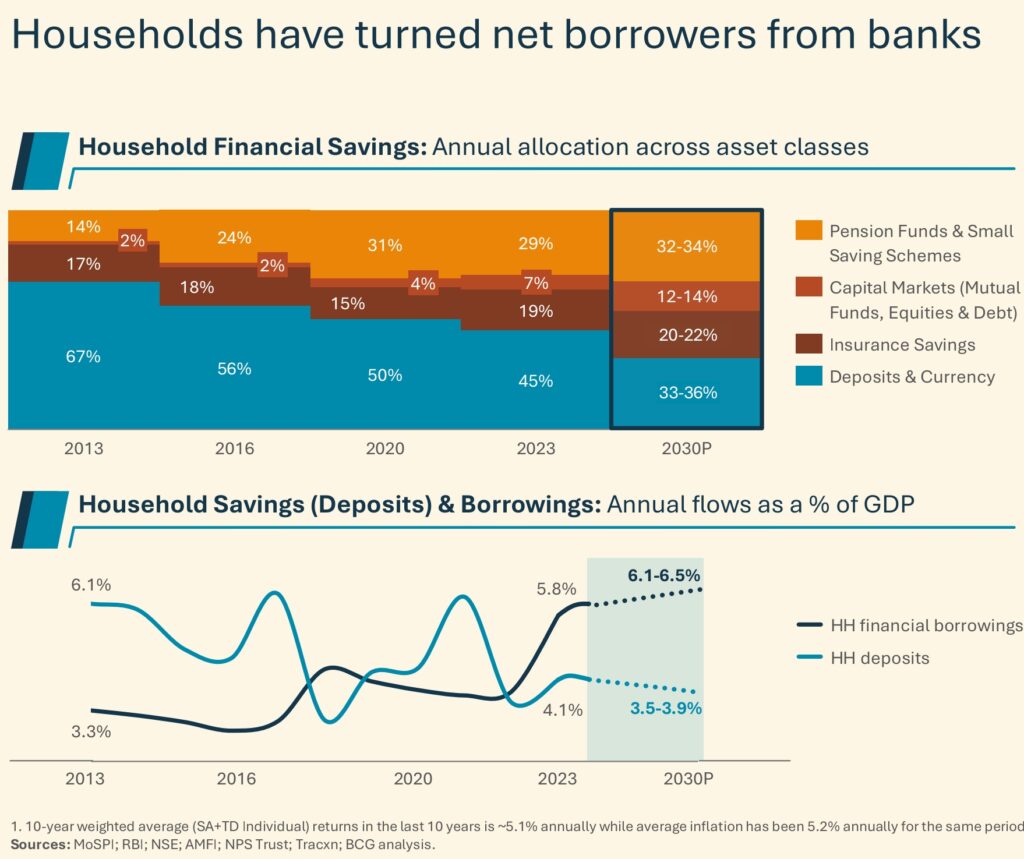

Adapting to evolving household behaviors: As households become net borrowers from the banking industry, banks need to reimagine their value proposition and develop innovative strategies to drive sustainable deposit growth while managing margin and liquidity pressures.

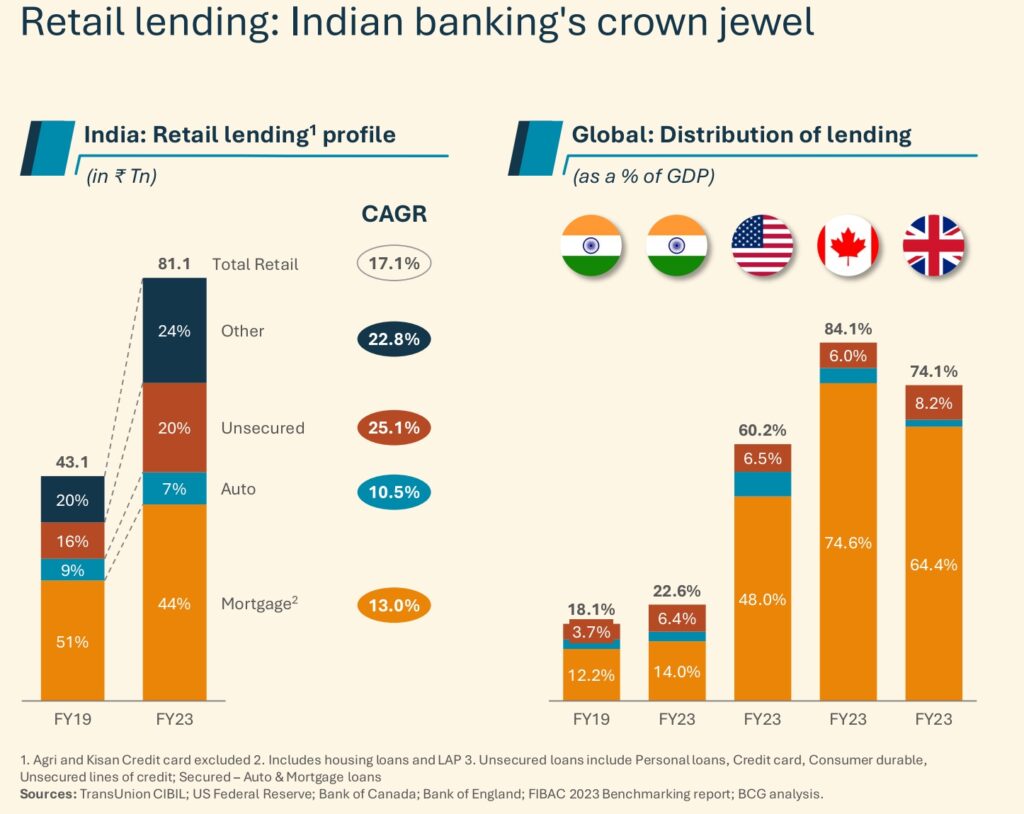

Navigating retail lending challenges: With pockets of high leverage emerging, banks must adapt to shifting market dynamics and explore new approaches to maintain the success of their retail lending businesses.

Addressing climate risk: Banks must proactively assess and manage climate-related risks in their portfolios, including transitioning to a low-carbon economy and supporting sustainable development initiatives.

Harnessing technology and data: Leveraging digital technologies and data analytics will enable banks to enhance customer experience, optimize operations, and drive innovation in product and service offerings.

Strengthening governance and risk management: Banks should continue to invest in robust governance structures and risk management frameworks to ensure long-term stability and resilience in the face of potential challenges.

By focusing on these key themes, the Indian banking in8dustry can play a pivotal role in achieving the ambitious goals of the Viksit Bharat mission and supporting India’s journey towards becoming a developed nation.

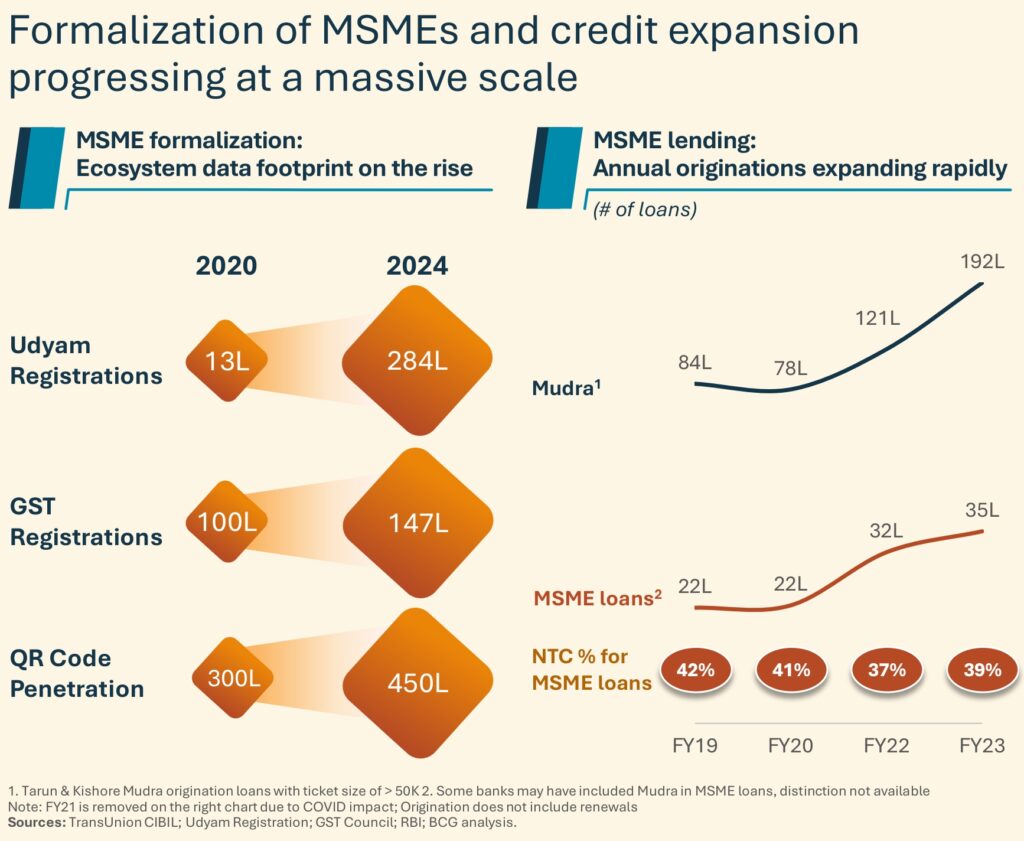

The formalization of Micro, Small, and Medium Enterprises (MSMEs) and the expansion of credit are taking place at an unprecedented scale in India. As these sectors continue to grow, lenders have the opportunity to leverage advanced analytics to reimagine MSME lending and drive profitability in the coming years. To capitalize on this opportunity, banks should focus on the following aspects:

Customized lending solutions: By utilizing data-driven insights and tailored approaches, banks can better cater to the unique needs of MSMEs and enhance credit access for this vital sector.

Streamlined processes: Simplifying loan application and disbursement processes will enable banks to serve more MSMEs effectively and efficiently.

Risk management: Advanced analytics can help banks better assess and manage risks associated with MSME lending, ensuring the long-term sustainability of this growing market.

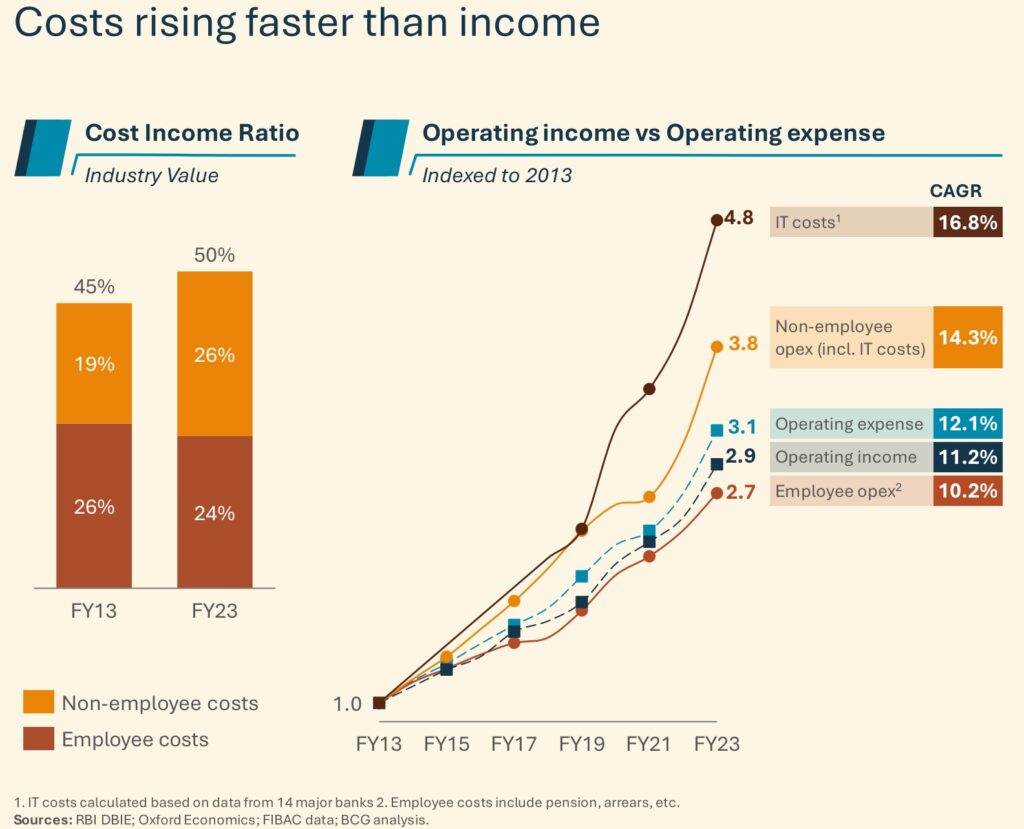

Over the past decade, rising costs have outpaced income growth, particularly due to a rapid increase in technology spending. To address this trend and improve overall efficiency, banks must completely reimagine their operational models. Some potential strategies include:

Digitization: Investing in digital technologies and infrastructure can help banks reduce costs, streamline operations, and enhance customer experience.

Employee upskilling: By investing in employee training and development, banks can drive productivity gains and adapt to evolving industry demands.

Collaboration: Partnering with fintech companies and other service providers can enable banks to leverage external expertise and resources, driving innovation and operational improvements.

Regarding digital maturity, select Indian banks are already on par with the global best. To maintain this competitive edge, banks should continue prioritizing digital innovation, cybersecurity, and data analytics, ultimately supporting India’s ambitious vision of becoming a developed nation by 2047.

India is taking strides towards becoming a developed nation by 2047 – the 100thyear of independence. This calls for consistent, sustainable economic growth with a systemic capacity for resilience. The financial sector and assets will have to scale up much more rapidly to achieve this aspiration. For GDP to grow to 10x, financial assets need to become 20x.

India’s financial sector will need to future-proof its business model to thrive and become more resilient, steering clear of extreme volatilities of the past cycles. An ambitious agenda needs to be set in place for the next two decades.

In the business Session: Future of household savings: Deposit mobilization for banks moderated by: Ms Neha Gupta, MD & Partner, BCG, the Panelists -Mr Ashwini Kumar Tewari, MD (Corporate Banking and Subsidiaries), State Bank of India Mr Prashant Kumar, MD & CEO, Yes Bank Mr Ratan Kumar Kesh, MD & CEO (Interim), Bandhan Bank Mr Pralay Mondal, MD & CEO, CSB Ms Beena Vaheed, ED, Bank of Baroda Mr Nilesh Shah, Group President & MD, Kotak Mahindra Asset Management.

The summary –

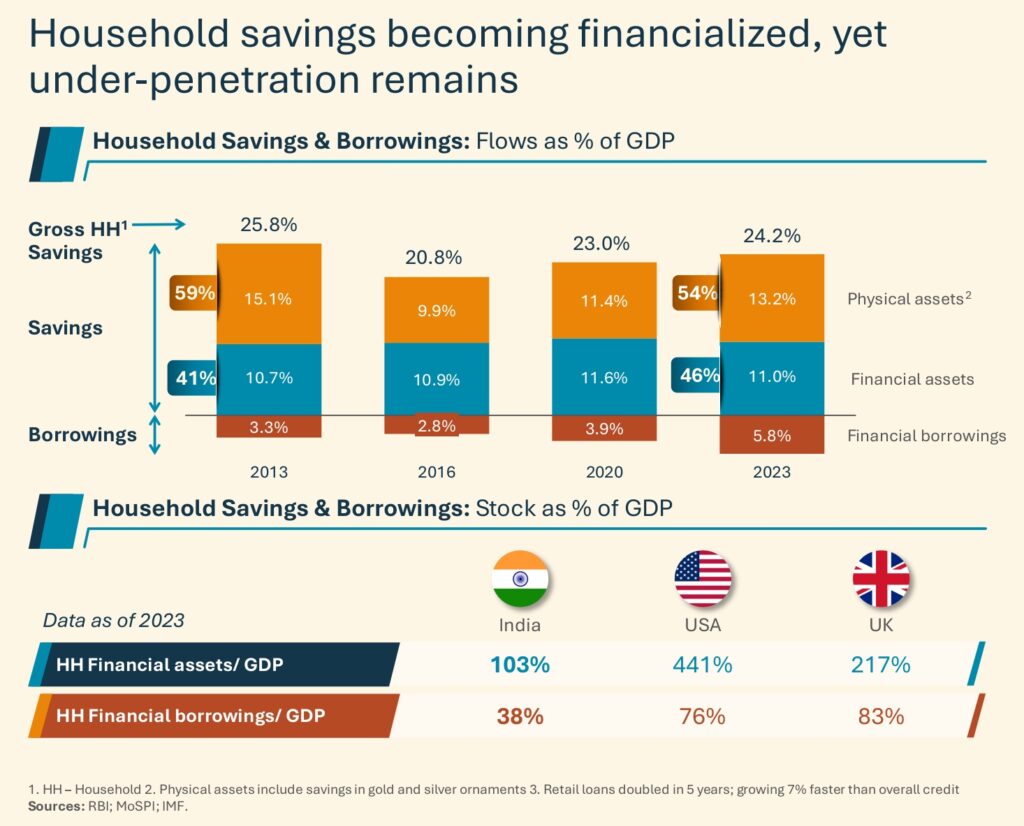

1. India’s household savings have shifted dramatically, with bank deposits’ share dropping from 67% to 33-36% over a decade as households increasingly favor equities, mutual funds, and pension products for higher returns.

2. Negative real returns on fixed deposits (5.1% vs. 5.3% inflation) and tax arbitrage (10% equity LTCG vs. 31.2% FD taxation) have accelerated this transition, particularly among millennials, 74.6% of whom prioritize market-linked instruments.

3. Banks face a liquidity crisis as credit growth (16%) outpaces deposits (13%), pushing the loan-to-deposit ratio to 82% for public sector banks, forcing reliance on high-cost wholesale certificates of deposit.

4. Demographic divides persist, with 60% of deposits held by seniors seeking safety, while younger generations use banks primarily for transactional needs, exacerbating asset-liability mismatches as loan tenures lengthen and deposit tenures shrink.

5. Regional disparities highlight opportunities, with rural deposits growing at 14% annually but underrepresented states like Bihar and UP contributing only 12% of deposits despite 28% population share.

6. Product innovation is critical, exemplified by CSB Bank’s G-Sec-linked FlexiRate FD (22% higher retention) and SBI’s senior citizen-focused Sarathi packages combining health services with deposits.

7. Regulatory reforms proposed include risk-based FD pricing (e.g., +50 bps for non-withdrawal commitments) and allowing banks to offer market-linked deposits with partial equity exposure to compete with mutual funds.

8. Liquidity management tools like exempting priority-sector deposits from CRR could free ₹8.4 lakh crore for lending, while municipal bond investments counted toward SLR would align deposits with infrastructure financing.

9. Rural strategies show promise, with Bandhan Bank’s ₹50/day micro-deposit scheme mobilizing ₹1,200 crore in 6 months and BoB’s women-centric Saathi program reducing CAC by 50% through SHG networks.

10. Banks are adopting relationship-based pricing, offering up to 25 bps higher FD rates for customers maintaining integrated financial portfolios spanning deposits, insurance, and investments.

11. AI-driven segmentation, like Kotak’s 811 Imperia identifying 15 customer personas, enables hyper-targeted products such as education-aligned FDs with staggered payouts.

12. Fintech collaborations help retain deposits, with Yes Bank’s API integrations on platforms like Groww recapturing 12-15% of outflows via in-app FD bookings at 30-40 bps referral costs.

13. Systemic solutions include redirecting ₹4.2 lakh crore of government funds from RBI to banks for liquidity relief and expanding corporate bond markets (currently 16% of GDP) through retail tax incentives.

14. Women-led financial inclusion is pivotal, as they influence 78% of household decisions yet are underserved, with initiatives like Yes Bank’s Deposit Shakti targeting women entrepreneurs through bundled credit-savings products.

15. The banking sector must balance serving risk-averse seniors with digital-first millennials, requiring regulatory modernization, hybrid deposit instruments, and repositioning banks as holistic financial advisors amid India’s financial maturation.

At the CII Financing 3.0 Summit in September 2024, SBI Chairman C.S. Setty highlighted the importance of formalization and credit absorption for MSMEs, emphasizing the role of NBFCs in driving credit growth and the need for banks to develop skills to assess emerging industries.

State Bank of India (SBI) Chairman Mr. Shetty acknowledged that despite being the public sector bank with the largest project financing department in the country, there is still a lack of expertise in assessing emerging areas within the infrastructure financing sector. Shetty, who assumed his position as SBI chairman on August 28, emphasized the crucial role of large banks in infrastructure financing.

To address this skills gap, Mr. Shetty announced plans to establish a center of excellence in collaboration with multilateral development banks and large multinational banks. This initiative aims to enhance the skillsets required to identify emerging areas and support the growth of the infrastructure financing sector effectively.

By fostering collaboration and knowledge sharing with global partners, the State Bank of India aims to strengthen its capabilities in project financing and contribute significantly to the development of infrastructure in the country. The proposed center of excellence would serve as a platform for capacity building, research, and innovation in the banking sector, ultimately enabling SBI to better serve the evolving needs of the Indian economy.

A large bank like SBI should not only be looking to finance MSMEs… we need to see whether we can hand hold them in terms of governance and technology.”

In addition to addressing the skills gap in infrastructure financing, SBI Chairman Mr. Shetty emphasized the need for greater support for micro, small, and medium enterprises (MSMEs) in India. He acknowledged that the fund requirements of these enterprises have increased, and as the country’s largest public sector bank, SBI should consider offering more assistance to help them grow.

By “hand-holding” MSMEs, SBI aims to play an active role in nurturing and empowering these businesses, which are crucial for driving economic growth, generating employment, and fostering innovation. This support could involve offering tailored financial solutions, providing mentorship and guidance, and facilitating access to networks and resources.

As a key player in India’s banking industry, SBI’s commitment to bolstering MSMEs and the infrastructure financing sector demonstrates its dedication to the nation’s overall economic development and the realization of the ‘Viksit Bharat’ vision. By prioritizing skill enhancement and partnership with global institutions, SBI seeks to create a more robust and inclusive financial ecosystem that can effectively support India’s ambitious growth targets.

Here’s a more detailed breakdown of his key points:

MSME Lending Challenges:

Shetty identified the lack of formalization in the MSME sector as a major barrier to lending, despite the availability of credit.

Credit Absorption:

He stressed that MSMEs struggle with absorbing credit, hindering their growth and scaling efforts.

Digitalization and GST:

He noted that advancements in digitalization and initiatives like GST have led to increased formalization, enabling banks to offer formal credit to MSMEs.

Role of NBFCs:

Shetty highlighted the critical role of NBFCs in driving credit growth within the MSME sector.

Emerging Industries:

He emphasized that despite SBI’s expertise in project financing, the bank needs to develop skills to assess emerging industries like electric vehicle battery developers and hydrogen fuel makers.

Collaboration and Skill Development:

To address the skill gap, Shetty mentioned SBI’s plans to set up a center of excellence and collaborate with multilateral development banks and large multinational banks.

Hand-Holding MSMEs:

Shetty also said that SBI should think about ‘hand-holding’ MSMEs, given their increased funding requirements.

Cash-Flow Based Lending:

Shetty also mentioned that SBI is looking at shifting to a cash-flow based approach for MSME loans, rather than relying solely on collateral.

Viksit Bharat:

The CII Financing Summit 3.0 aimed to discuss the future of India’s financial sector in the context of the nation’s vision for a “Viksit Bharat” or Developed India by 2047.